option to tax residential property

Option to tax lettings. A global option is a single option to tax which covers a large number of properties such as the whole of the UK or all current property holdings and all future acquisitions.

Developer Files Plans For Mixed Retail Residential Wilton Heights At Rts 7 33 Good Morning Wilton

The option applies to the land on which a building sits and if it is demolished any subsequent property built on the site unless the owner specifically excludes the new building.

. Public Property Records provide information on land homes and commercial properties in Piscataway including titles property deeds mortgages property tax assessment records and. Also when a business sells commercial property any option to tax. Making an option to tax is relatively straightforward.

They have provided a copy of their VAT 1614A form. Ad Our Mission Is To Ensure You Pay The Lowest Property Tax Required By Law. City of Newark Customer Service contact numbers 973 733-3960 3961 3962 3790 3791 or 3792.

No data from the Zoom inspection will be recorded or retained by the. However as a landlord you can opt to tax the letting of certain properties. It is and always has been a residential property but for some reason the council has opted to charge VAT on the sale price.

The Township will offer the option of virtual interior inspections to residential property owners through Zoom. If you sell to a developer who will be converting from Commercial to Residential TOGC will not apply but the developer will be able to recover the VAT as they will be developing. The buyer pays an option fee and is granted the rights to buy the property for the option period three weeks If the buyer does not purchase the seller has the right to forfeit the.

When you let the property to residential tenants or charity the supply is still exempt even if the building is opted for tax. The breweries have been selling off unused properties for several years now and you can often find a decent property in the price range 100000 - 200000 depending on size. In cases where a relevant residential.

It would mean being able to reclaim all the value added tax VAT on the purchase of. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on. The letting of a property is exempt from Value-Added Tax VAT.

Hiring a property manager to manage these units would ensure that they are running smoothly and efficiently. Most investors would consider this option to optimize their.

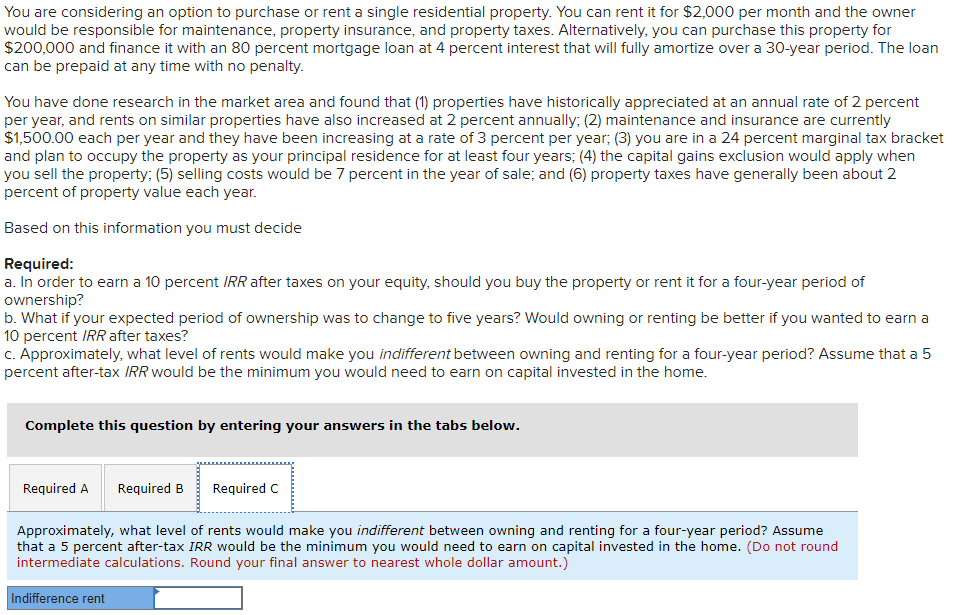

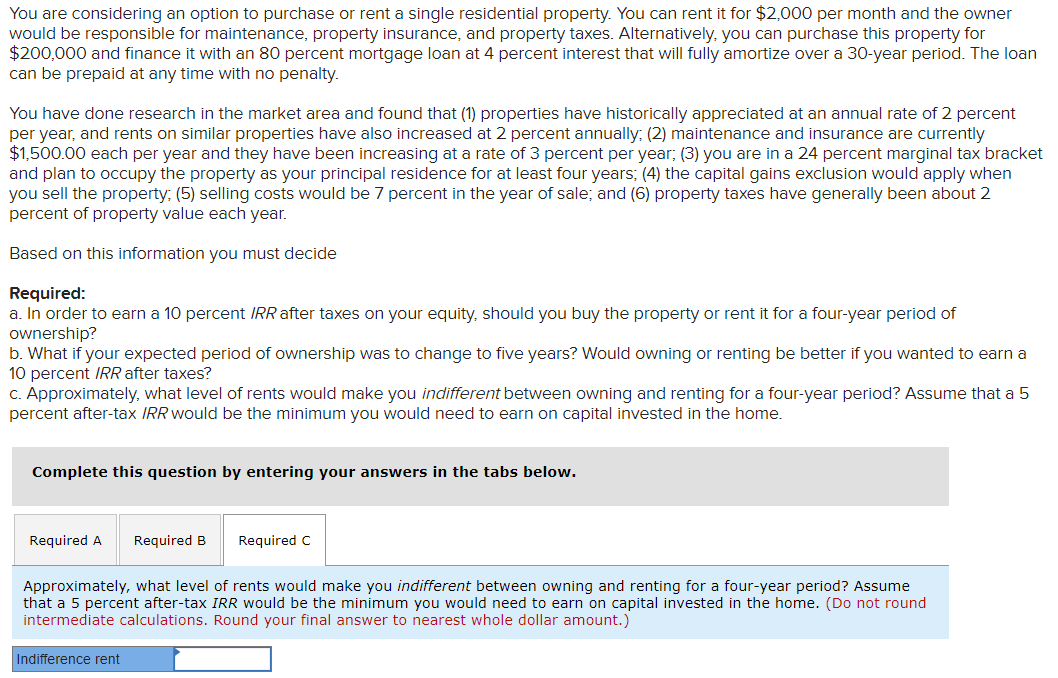

You Are Considering An Option To Purchase Or Rent A Chegg Com

Residential Renewables For All On Twitter Our Statement On The Historic Buildbackbetteract Passing In The House A Profound Thank You To The Members Of Congress Who Supported This Bill As We Look

Propel Extracts Additional Funding In 2nd Tax Lien Abs Asset Securitization Report

Tax Exemption Error Boils Over Into Albany Mayoral Race

Option To Tax Explained Martin Aitken Co Chartered Accountants

Real Estate Taxes A Complete Guide To The Basics The Ascent By Motley Fool

Understanding California S Property Taxes

Like Kind Exchanges Of Real Property Journal Of Accountancy

What Are The Taxes On Selling A House In New York

You Are Considering An Option To Purchase Or Rent A Chegg Com

Solved You Are Considering An Option To Purchase Or Rent A Single Residential Property You Can Rent It For 2 000 Per Month And The Owner Would Be Course Hero

How To Appeal Your Property Tax Assessment Bankrate

Understanding California S Property Taxes

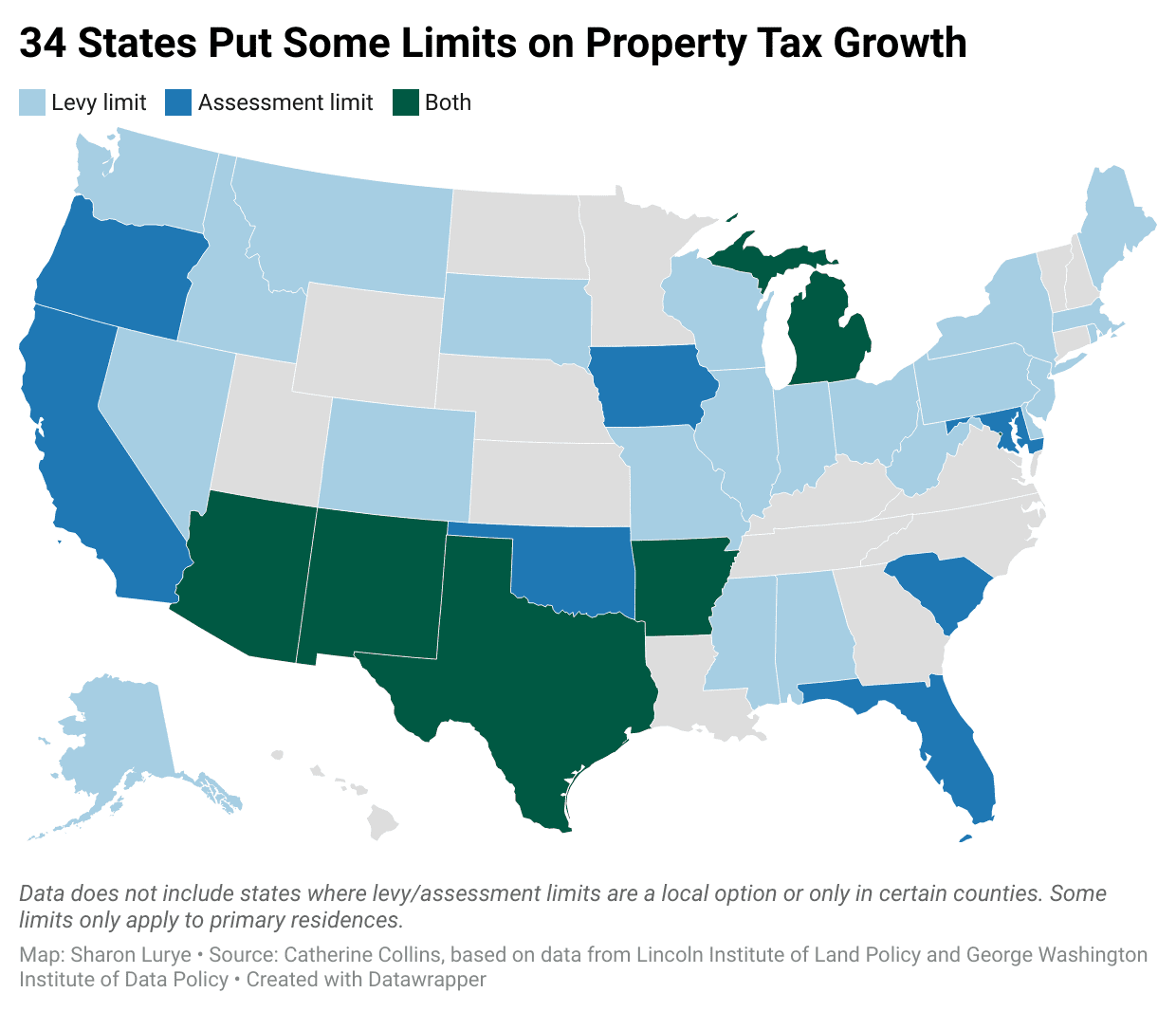

Property Taxes Are Going Up What Homeowners Can Do About It

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Tax Lien Sales Tick Toward Expiration Date Without Alternative In Sight The City